There are several reasons for analysts to remain optimistic about cryptocurrencies. Lower inflation rates and the possibility of a U.S. spot bitcoin ETF approval set the stage for analyzing other cryptocurrencies like Cardano (ADA), Ripple (XRP), Chainlink (LINK), and ScapesMania (MANIA).

By: OLIVER DALE

The cryptocurrency market is currently experiencing a downturn, with major cryptocurrencies like Bitcoin (BTC) and Ether (ETH) seeing significant declines. Bitcoin has dropped by 4% to around $35,000, and Ether has fallen by nearly 6%. This trend is in contrast to the traditional financial markets, which have shown improvement following a recent slowdown in inflation.

Despite these challenges, analysts remain optimistic about the future of the cryptocurrency market. Factors such as lower inflation rates and the potential approval of spot bitcoin ETFs in the US are expected to have a positive impact in the long term. This current market situation sets the stage for our analysis of Cardano (ADA), Ripple (XRP), Chainlink (LINK), and the emerging ScapesMania (MANIA).

As the dynamic sequence of events continues to unfold, even the savviest traders have to wonder what impact, if any, a bitcoin ETF will have on these digital assets. That’s the question that we will explore in today’s write-up.

- ScapesMania (MANIA) is gaining attention with its innovative approach and strong presale performance, indicating potential for substantial growth.

- Cardano (ADA) shows resilience and potential for growth, buoyed by increasing user adoption and transactional activity, despite market consolidation.

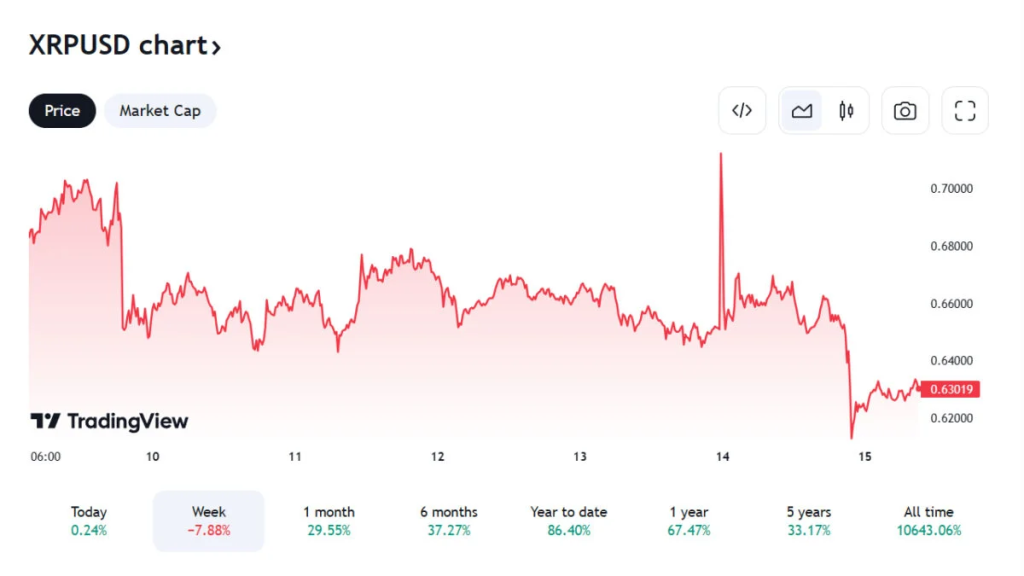

- Ripple (XRP) price is highly sensitive to market news and rumors, as evidenced by its recent speculative swings, indicating a volatile yet opportunistic future.

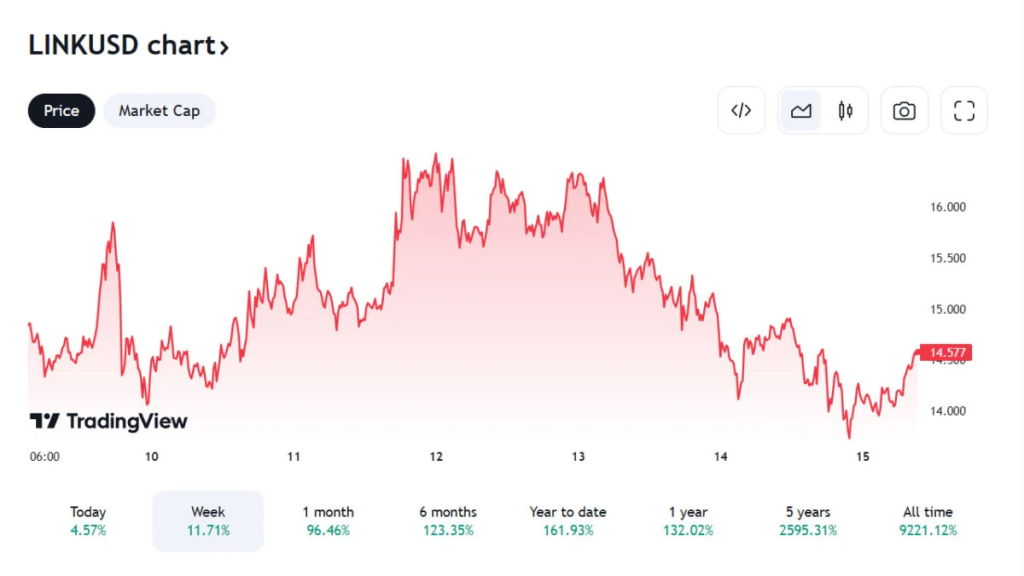

- Chainlink (LINK) has seen a significant surge in market performance, driven by real-world asset tokenization and institutional adoption, suggesting a promising future.

The Rising Star: ScapesMania’s Market Entry

Many crypto experts pick ScapesMania as the best new project of 2023 and beyond. It manages to separate itself from the competition by offering holders a multitude of revenue streams and high potential ROIs during presale.

Companies and individual crypto traders looking for fast potential gains should definitely look into ScapesMania’s proposition. Once the presale finishes, the price will soar, securing possible returns in the range of 400-500%. Right now, there’s an active discount of close to 85%, but it won’t last forever – the clock is ticking and all interested in leveraging this offer need to act fast.

When dissecting the tokenomics and other features of ScapesMania, it becomes clear that it’s the best altcoin to hold now. The innovative gaming-related core idea, impressive presale numbers, $150,000 giveaway, undying social media hype, and other positive aspects can guarantee that ScapesMania will continue on its winning journey, so it makes sense to get involved as soon as possible.

Cardano (ADA): Market Consolidation and User Growth

Cardano (ADA) is currently in a phase of consolidation, maintaining stability above the $0.35 support zone. Despite a recent failure to break above the $0.40 mark during the last week’s altcoin rally, Cardano (ADA) is showing signs of resilience. This is particularly evident as it continues to attract new users, a key indicator of a healthy and growing ecosystem. The IntoTheBlock data reveals that the Cardano (ADA) new user adoption rate has recently peaked, maintaining a rate above 30% over several days, which is a significant achievement compared to the last three months.

Cardano (ADA) price movement is currently in a consolidation phase, hovering around crucial support and resistance levels. The 10-day moving average stands at $0.366, while the 100-day moving average is at $0.275. This suggests a potential for upward movement if the market conditions remain favorable. The support levels are set at $0.150 and $0.214, with resistance levels at $0.343 and $0.408.

The increasing transactional activity among new and existing market participants could heat up demand for the Cardano (ADA) network in the days ahead. This rising demand, coupled with the strong support buy wall around the $0.35 area, suggests that Cardano (ADA) could be poised for a rebound towards the $0.40 mark.

Ripple (XRP): Market Sensitivities and Speculative Swings

Ripple (XRP) recently experienced a dramatic price surge, followed by an equally swift decline, due to market reactions to a fake news event. A false filing suggested that BlackRock, a major asset manager, was creating an Ripple (XRP) exchange-traded product, leading to a 12% spike in Ripple (XRP) price. This spike was short-lived, as the news was quickly debunked, causing Ripple (XRP) to lose its gains almost as rapidly as it had gained them.

Currently, Ripple (XRP) is trading within the range of $0.509 to $0.655. The 10-day moving average for Ripple (XRP) stands at $0.666, slightly above its 100-day moving average of $0.545. This indicates a potential for upward movement, albeit within a volatile market context. The support levels for Ripple (XRP) are currently at $0.272 and $0.418, while the resistance levels are at $0.710 and $0.857.

The future of Ripple (XRP) appears to be closely tied to its responsiveness to market news and investor sentiment. Looking ahead, Ripple (XRP) ability to stabilize and grow will depend on navigating these market sensitivities effectively.

Chainlink (LINK): A Surge in Market Performance and Adoption

Chainlink (LINK) recently experienced a significant surge, increasing by 26% between November 2 and 8, reaching around $14, a level not seen since April 2022. This impressive performance has been driven by expectations of real-world asset (RWA) tokenization and initial signs of institutional adoption. Notably, Chainlink (LINK) ecosystem has seen positive developments, such as the partnership between Vodafone and Sumitomo Corporation, which utilizes Chainlink (LINK) oracles. This partnership, along with the broader trend of RWA tokenization, as evidenced by HSBC’s launch of custody services for regulated securities, indicates a growing demand for Chainlink (LINK) oracle solutions.

Currently, Chainlink (LINK) is trading within a range of $8.30 to $13.22. The 10-day moving average stands at $14.62, indicating a potential for continued upward movement. The 100-day moving average is at $8.27, further underscoring the recent positive trend. Chainlink (LINK) support levels are at $0.33 and $5.25, with resistance levels at $15.09 and $20.01.

The future of Chainlink (LINK) appears promising, with its recent price surge supported by increased network activity and a high demand for its oracle solutions. The partnership with major corporations and the trend towards RWA tokenization suggest a growing institutional interest in Chainlink (LINK).

Conclusion

The potential approval of a Bitcoin ETF in the US is likely to have a significant impact on the cryptocurrency market, including Cardano (ADA), Ripple (XRP), and Chainlink (LINK). For Cardano (ADA), this could mean enhanced investor confidence and market growth. Ripple (XRP), known for its market sensitivity, might see a notable positive price movement, albeit with potential volatility. Chainlink (LINK), with its recent surge and institutional adoption, could gain further from increased legitimacy and interest in the crypto space. ScapesMania (MANIA), as a new entrant, might also benefit from the increased market attention and investor interest that typically follows such major developments in the crypto space.

See source article HERE

Disclaimer: The information provided on this page does not constitute investment advice, financial advice, trading advice, or any other sort of advice and it should not be treated as such. This content is the opinion of a third party and this site does not recommend that any specific cryptocurrency should be bought, sold, or held, or that any crypto investment should be made. The Crypto market is high risk, with high-risk and unproven projects. Readers should do their own research and consult a professional financial advisor before making any investment decisions.